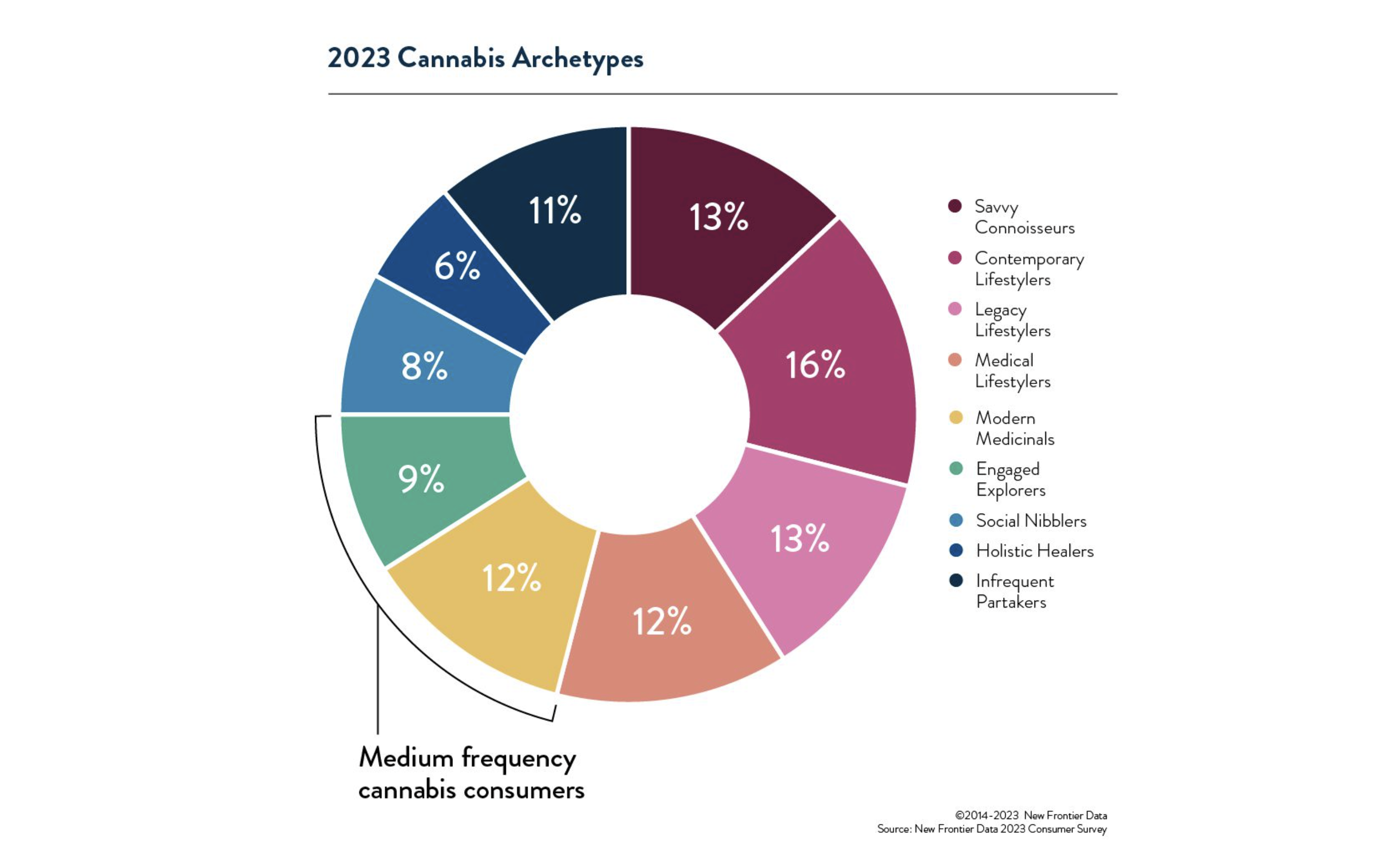

New Frontier Data presents the 2023 archetypes of cannabis consumers in America. The report highlights nine consumer archetypes based on the latest consumer survey data.

The first archetype is Savvy Connoisseurs, comprising 13% of consumers. They are heavy cannabis users who consume it multiple times a day for various medical and recreational purposes. They obtain cannabis from both legal sources like dispensaries and informal channels such as friends or illicit dealers. Savvy Connoisseurs are the highest spenders and often purchase cannabis weekly.

The second archetype is Contemporary Lifestylers, representing 16% of consumers. They primarily use cannabis recreationally to relax. They prefer smokable cannabis but also try non-smokable products occasionally. All Contemporary Lifestylers live in states where cannabis use is legal and rely on regulated sources like dispensaries. They are moderate-to-high spenders and frequently acquire cannabis.

The third archetype, Medical Lifestylers, makes up 12% of consumers. They are frequent cannabis users who primarily use smokable products but occasionally explore edibles or other non-smokable forms. Medical Lifestylers consume cannabis for medical reasons, such as pain management or treating medical conditions. They mainly obtain cannabis from legal dispensaries and delivery services. Medical Lifestylers are the second-highest spenders after Savvy Connoisseurs.

The fourth archetype, Legacy Lifestylers, represents 13% of consumers. Like other Lifestyler archetypes, Legacy Lifestylers are frequent cannabis consumers who predominantly smoke cannabis for recreational purposes. However, they live in states where cannabis is illegal or are unregistered patients in medical-only states, limiting their access to legal dispensaries. Therefore, they primarily rely on friends and illicit dealers for their cannabis supply. Legacy Lifestylers acquire cannabis with similar frequency as their legal counterparts and spend only slightly less per purchase.

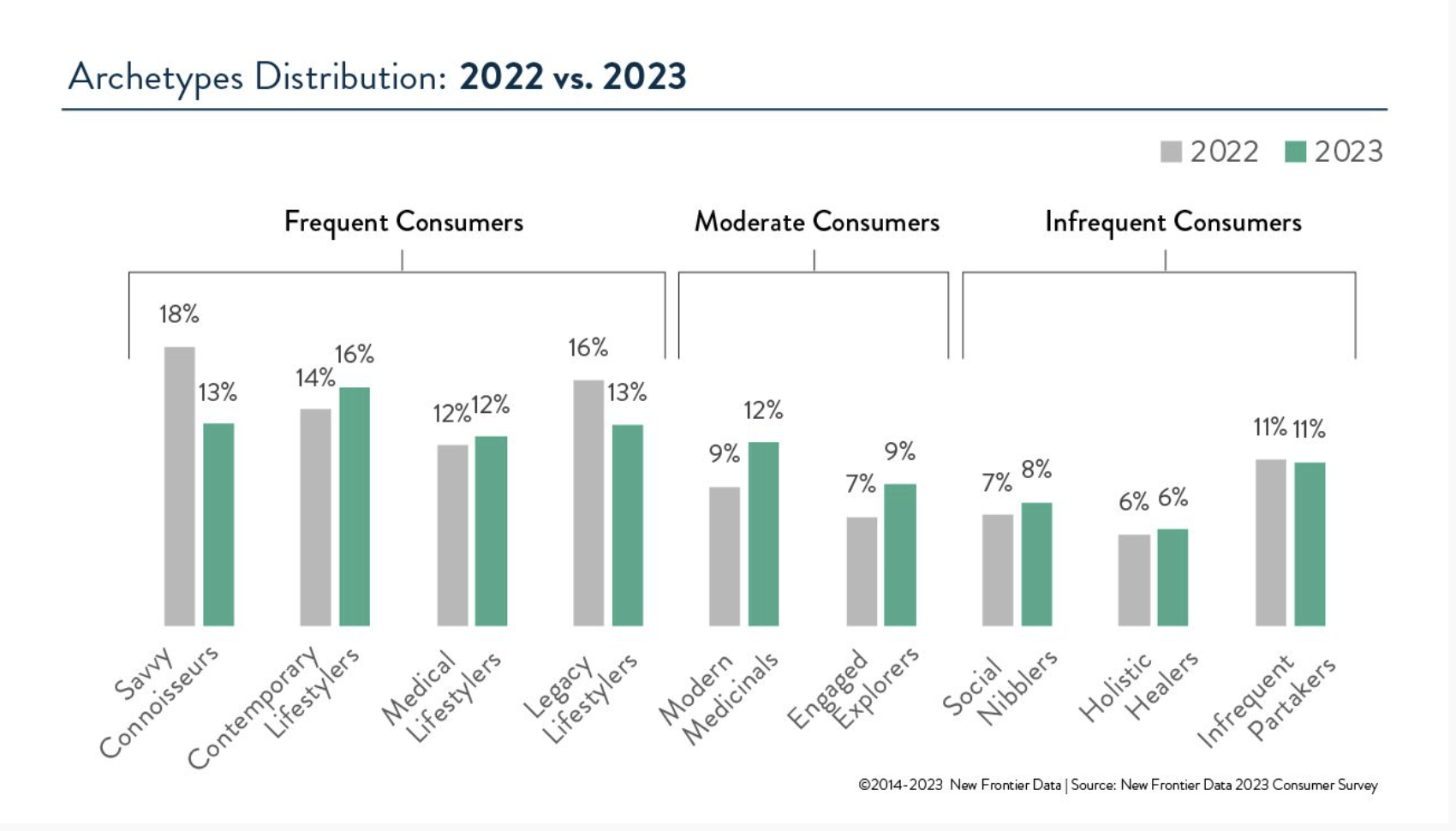

The data highlights changes in consumer distribution among the archetypes compared to the previous year. The Legacy Lifestyler archetype has decreased from 16% to 13% due to the expansion of legal access to cannabis in several states. As more states legalize cannabis, Legacy Lifestylers are expected to transition into the Contemporary and Medical Lifestyler archetypes based on their medical or recreational goals. Over time, exposure to a wider range of legal cannabis products may lead them to prefer non-smokable options and potentially shift to other archetypes.

The Savvy Connoisseur archetype has also reduced in size from 18% to 13%, potentially influenced by new consumers entering the market and pandemic-related changes in consumption habits. Consumers in newly legal markets may have established their preferred products and routines, requiring less experimentation. As cannabis becomes more mainstream, the need to educate friends about new products or procure products for social circles may also decrease.

For effective communication with these consumer segments, the article suggests reaching out to NXTeck’s B2C division, which specializes in delivering targeted digital campaigns in the cannabis industry. NXTeck offers audience targeting, analytics, and attribution reporting based on location, point-of-sale, and social science data, utilizing the industry’s largest cannabis and CBD consumer audience dataset.

For further information on the consumer archetypes, the complete report will be released next month. For inquiries, contact NXTeck via email at sales@nxteck.com.

Source: NewFrontierData

EXPLORE MORE NEWS

Newsletter