Texas Medical Cannabis – Market Statistics Update November 2023 (available on TexMed App – TexMedCannabis.com)

The Texas Department of Public Safety’s latest data for November 2023 provides an impactful snapshot into the state of Texas medical cannabis landscape. These statistics unveil a perspective on large patient and limited physician growth, as well as the current state of accessibility within the Lone Star State.

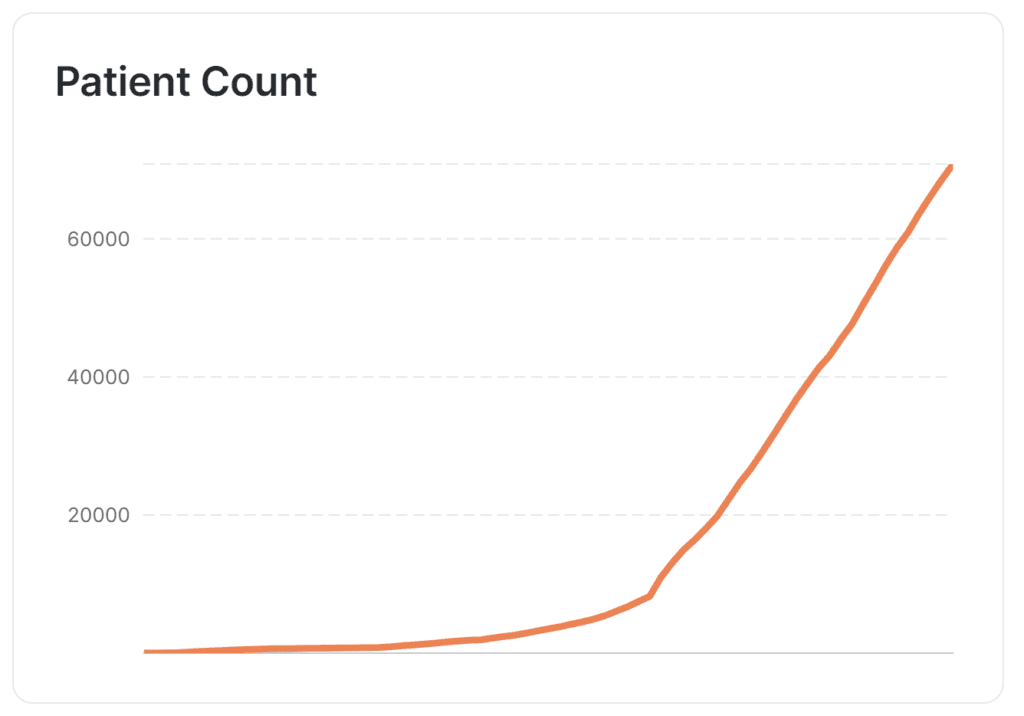

Patient Growth:

In November 2023, Texas witnessed an increase in registered patients, reaching a total of 70,835. This marks a notable 3% growth from the previous month, showcasing the state’s sustained momentum in medical cannabis sign ups. Comparing this figure to the same month in the previous year, the patient count has surged by an impressive 72%, indicating a robust upward trend in demand that has created the hockey stick shape below.

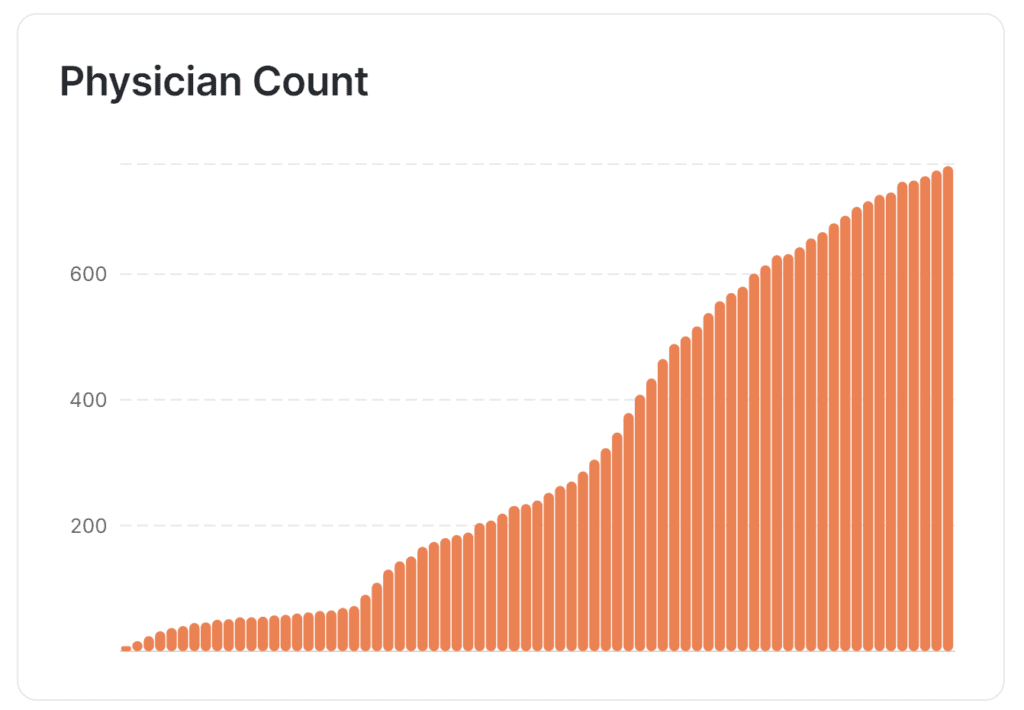

Physician Registration:

The state’s physicians that prescribe medical cannabis has also experienced growth, with 772 registered physicians documented in the latest November data. This represents a steady 1% increase from the previous month, reflecting ongoing engagement and interest among healthcare professionals. Over the past year, the number of registered physicians has seen a substantial 18% growth, indicating positive trends in attracting and retaining medical practitioners.

Patient-to-Physician Ratio:

The patient-to-physician ratio currently stands at 92 patients per physician. This ratio has grown by 2% from the previous month, underscoring the increased demand for healthcare services. Over the past year, there has been a significant 46% growth in the patient-to-physician ratio, emphasizing the ongoing challenges in healthcare access and the importance of optimizing the distribution of medical resources.

Access to Medical Products:

A striking observation pertains to the limited access to medical products for the 70,835 registered patients. Presently, only three active companies facilitate access, with fewer than 30 locations available for patients who actively participate in the program. This highlights a significant gap in accessibility and emphasizes the pressing need for broader availability and increased options for patients to ensure comprehensive and effective healthcare delivery.

Relative Scale:

In a state as vast as Texas, boasting a population of 30,000,000, the 70,835 registered medical cannabis patients constitute only 0.2% of the total population. This statistic serves as a compelling reminder of the considerable potential for further expansion and development in the state’s medical cannabis program. The relatively low percentage underscores the opportunity to enhance outreach efforts, engage more residents, and address the healthcare needs of a larger portion of the population.

November 2023 data showcases positive trends in patient and physician growth, highlighting the need for ongoing efforts to enhance medical cannabis healthcare infrastructure, accessibility, and the availability of medical cannabis products in Texas.

Comparison with Florida Medical Market

Florida’s Growing Patient Count

At the end of 2022, Marijuana Policy Project (MPP) reported that Florida had 831,775 registered patients, making up 3.74% of the state’s population. This highlights the increasing acceptance of medical cannabis as a viable treatment option.

Extensive Dispensary Network

To cater to this demand, Florida has 501 active dispensaries, operated by 22 different companies, with more on the way. This shows the competitive nature of the industry and ensures patients have convenient access to their prescribed treatments.

Florida’s Medical Cannabis Program is thriving, with a significant patient count and a robust dispensary network, exemplifying the program’s success and the growing role of medical cannabis in the state’s healthcare landscape.

News on the latest application round

More than 130 applications have been submitted to the Texas Department of Public Safety for vertically integrated medical marijuana dispensaries, marking a significant response since the reopening of applications in January after a four-year hiatus.

Despite a recent bill to expand the state’s medical marijuana program stalling in the Senate, the DPS reports no current plans for usage law expansion, emphasizing their commitment to ensuring statewide access to low-THC cannabis for registered patients. For further details, visit KVUE.

Watch the TexMed APP launch video on YouTube

If you’re looking to stay in tune with the Texas Medical market, please check out TexMedCannabis.com

EXPLORE MORE NEWS

Newsletter