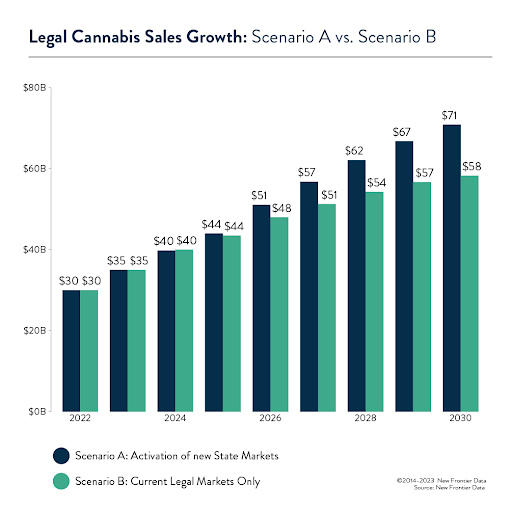

Setting the stage, it’s important to note that 24 U.S. states have legalized both Adult-Use and Medical-Use cannabis, 16 states have sanctioned Medical-Use exclusively, and 11 states maintain no legal cannabis market whatsoever. This translates to nearly 75% of Americans, roughly 250 million individuals, residing in states with varying degrees of access to high-THC legal cannabis. According to New Frontier Data’s analysis, the U.S. cannabis market’s legal sales were estimated at approximately $30 billion in 2022, and projections indicate they are poised to surpass $35 billion in 2023.

Setting the stage, it’s important to note that 24 U.S. states have legalized both Adult-Use and Medical-Use cannabis, 16 states have sanctioned Medical-Use exclusively, and 11 states maintain no legal cannabis market whatsoever. This translates to nearly 75% of Americans, roughly 250 million individuals, residing in states with varying degrees of access to high-THC legal cannabis. According to New Frontier Data’s analysis, the U.S. cannabis market’s legal sales were estimated at approximately $30 billion in 2022, and projections indicate they are poised to surpass $35 billion in 2023.

Despite the industry’s ongoing journey toward mainstream acceptance, it grapples with multifaceted challenges including federal policy inaction, downward price pressures, and limited access to capital. However, a particularly significant thorn in the industry’s side is the persistent dominance of the illicit market.

Illicit cannabis sales skyrocketed to $77 billion in 2022, more than double the total legal sales during the same period. Even within existing legal markets, New Frontier Data’s forecasts indicate that the illicit market will maintain its stronghold over legal sales until 2030.

Notably, an increasing number of consumers are opting to purchase their cannabis from brick-and-mortar dispensaries. A substantial 43% of current consumers revealed that their primary cannabis source is a physical dispensary—an impressive upswing from the previous year’s 34%. It’s evident that local market dynamics play a pivotal role in determining where consumers choose to procure their cannabis products.

Anticipating future developments, it’s anticipated that new markets will emerge in the coming years. To explore a comprehensive list of markets tracked by New Frontier Data and their anticipated timelines for legalization, one can refer to the 2023 U.S. Cannabis Report. The advent of these markets would likely propel annual legal market sales forward, potentially enabling legal sales to surpass illicit sales by 2028. By 2030, it’s projected that the legal market could account for 58% of all cannabis sales in the United States.

When comparing the current landscape of legal states to this potential model, a remarkable $13 billion (equivalent to a 22% growth) in annual sales could materialize by 2030. Furthermore, if these states proceed to expand legal access within the next few years, only three states would remain devoid of a legal cannabis market. This scenario would signify that an impressive 94% of Americans would reside in states where some form of high-THC legal cannabis is accessible.

For those seeking deeper insights into the cannabis industry’s most pressing challenges and promising opportunities, as well as an exploration of shifting consumer preferences since the previous year, a valuable resource is Equio—an essential reference point for staying informed.

Source: NewFrontierData

EXPLORE MORE NEWS

Newsletter