Can it find acceptance in Peoria? This quintessential American question examines the likelihood of a new trend, behavior, or occurrence gaining widespread approval. The term “Peoria” refers to the city in Illinois and embodies the notion that if a concept gains traction in the Midwest, it attains a mainstream status. When the wave of cannabis legalization emerged in 2012, it primarily took root in predictable locales – the coasts. Early victories for legalization in states like Colorado, Oregon, Washington, and Maine were not unexpected, given their reputation for a blend of progressive and Libertarian-leaning politics. However, the real question lingered: When would this movement extend to the Heartland? The answer arrived in 2018, when Michigan became the first Midwestern state to endorse adult-use legalization. With progressive pockets such as Ann Arbor and the presence of an urban hub like Detroit, Michigan might have been perceived as an outlier. Subsequently, Illinois followed suit in 2020, and to the astonishment of many, Missouri in 2022. The latest addition to this Midwestern lineup is Minnesota, with its recent introduction of an adult-use cannabis initiative. Ohio aims to place a similar measure on the ballot in 2024. As for Iowa, Indiana, and Wisconsin? The prospect appears remote.

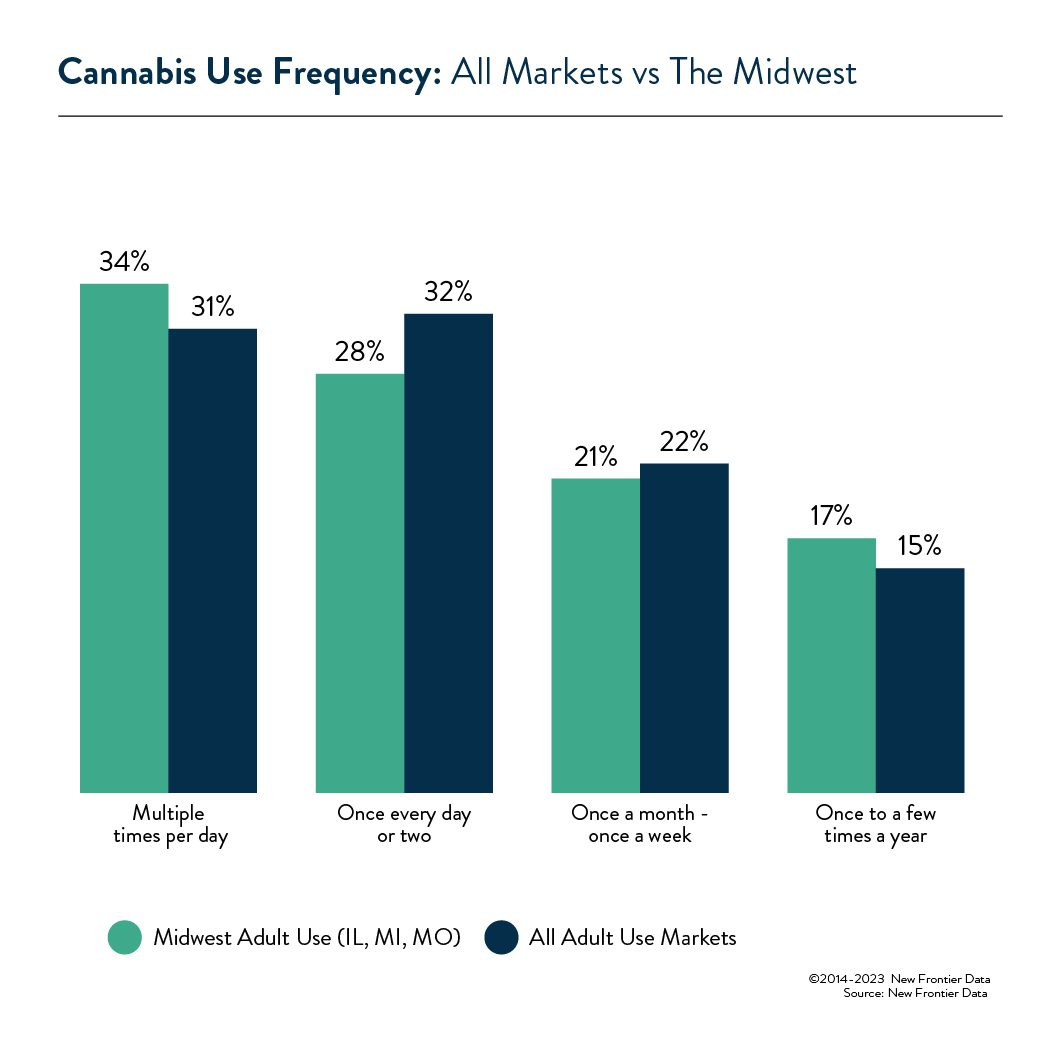

This raises an intriguing query: Does the consumption behavior of Midwestern cannabis users diverge from that of the broader adult-use population? If so, might these distinctions be tied to the lingering stigma in these states? In commemoration of Minnesota’s program launch, we delved into usage frequency and favored ingestion methods of Midwestern consumers in adult-use states (MI, IL, and MO) versus the general U.S. adult-use consumer populace.

In comparison to their counterparts across all adult-use markets in the U.S., Midwestern consumers exhibit a slightly higher likelihood of reporting multiple daily cannabis usage instances (34% vs. 31%). Conversely, they are somewhat less inclined to report consuming cannabis once every day or every other day (28% vs. 32%). The extended history of cannabis prohibition and the persisting stigma in this region (excluding Ann Arbor, MI, which decriminalized cannabis possession in 1974, not without contention) could signify that legalization has unlocked opportunities that citizens are eagerly seizing.

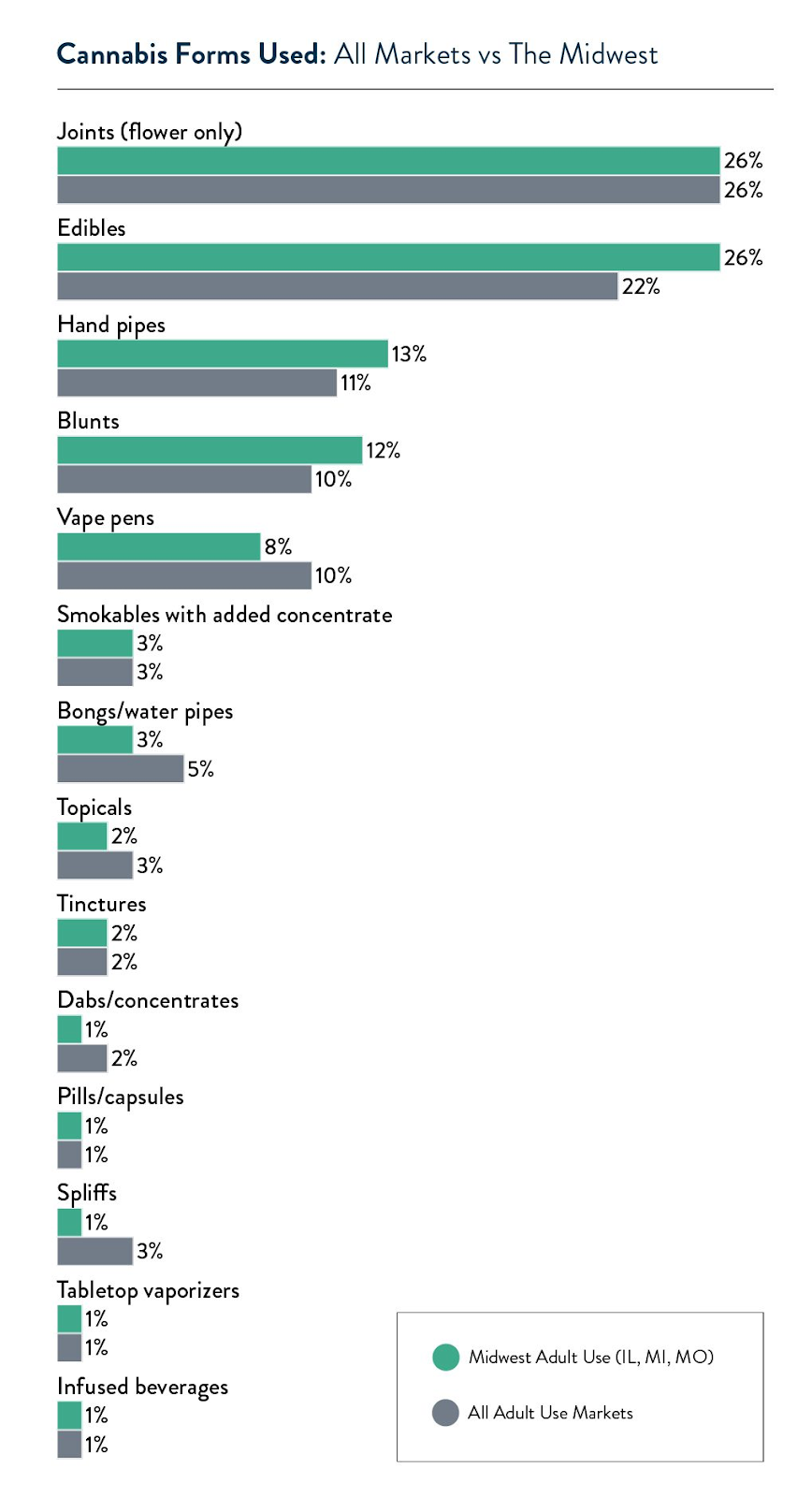

Midwest Product Preferences

Midwestern consumers express a marginal inclination towards favoring edibles when contrasted with the general adult-use consumer populace (26% vs. 22%). This variance might arise from the lingering societal apprehension towards cannabis, motivating discreet consumption. Alternatively, given that states like California and New York boasted thriving unregulated markets before legalization, the accessibility of edibles might have been more limited in Midwestern markets, rendering them an appealing novelty for many consumers.

So, can it indeed find approval in Peoria? It is conceivable, albeit with caveats. The clutches of prohibition and the persistent misconceptions surrounding cannabis consumption continue to hold sway in various states across the U.S. The legalization of cannabis in these regions could be attributed to the revenue drain experienced as residents travel to neighboring legal states. Witnessing cannabis legalization in the Wholesome Heartland, however, signifies a paradigm shift, marking a society that has transcended viewing cannabis as the “devil’s lettuce” and is ready to advance beyond the “Just Say No” era.

Source: Newfrontierdata

EXPLORE MORE NEWS

Newsletter