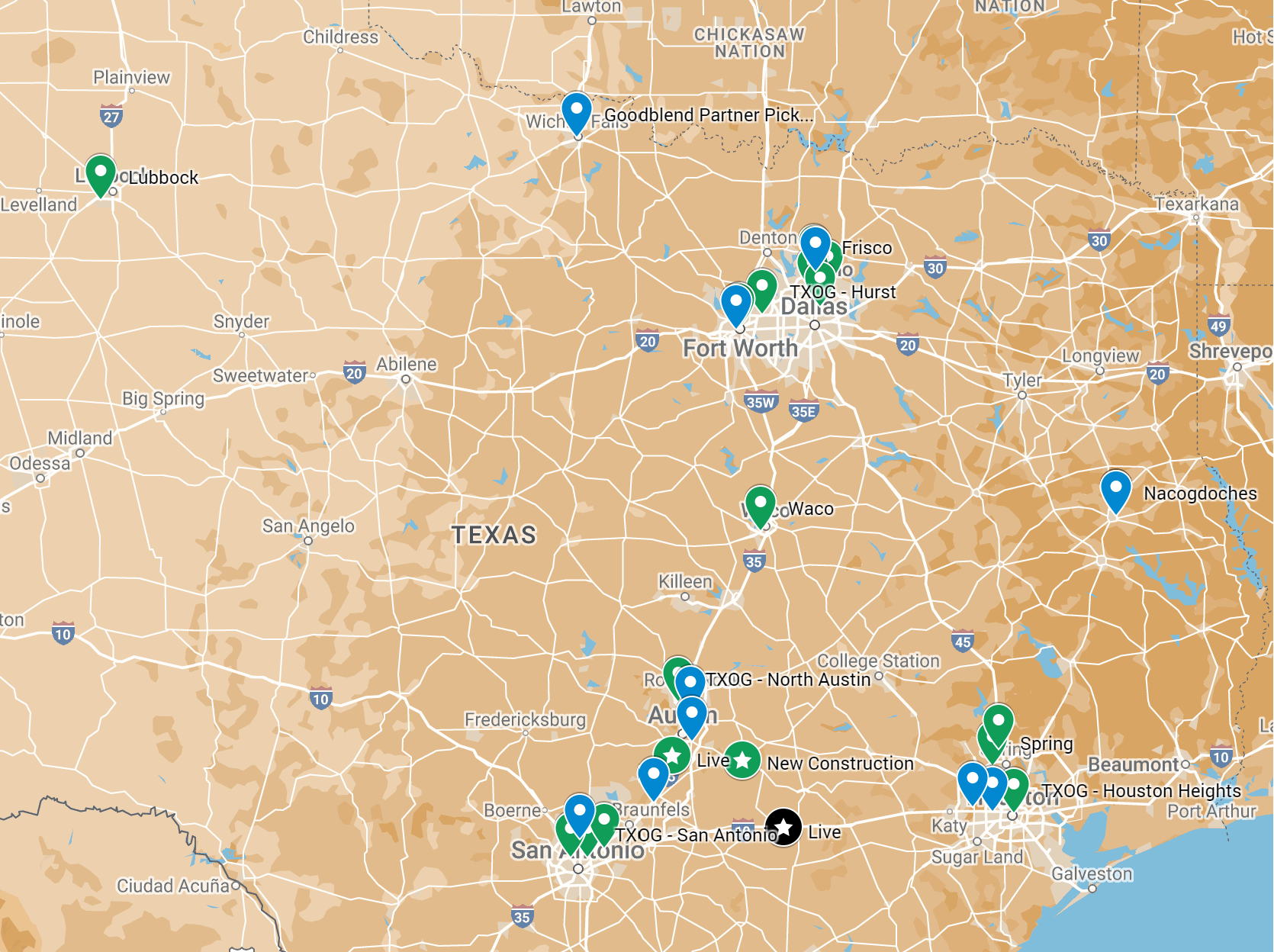

Here is a map of all the cannabis stores in Texas 2024

In recent years, Texas has experienced a profound transformation in its stance towards medical cannabis. Once notorious for its stringent regulations on cannabis, the Lone Star State has now embraced the legal medical use of cannabis. This article serves as your guide to see a map and navigate the ever-evolving cannabis landscape in Texas in 2024.

The Legal Framework:

Texas Compassionate Use Program was enacted by the 84th legislative session with Senate Bill 339 which was led by Rep. Stephanie Klick among many others to develop a registry of physicians to treat epilepsy with low THC medical cannabis (less than 1%), this registry is called Compassionate Use Registry of Texas or sometime referred to as CURT and is managed by the Department of Public Safety (DPS).

Market Growth

The program began to grow with the issuance of licenses in 2017 to 3 organizations who through substantial vetting became the 3 licensed operators. In 2019 a brief window to apply became available where dozens of companies applied though no additional licenses were issued. The rationale of no new licenses was due to the requirement that the department issue at least three licenses but no more than the number of licenses necessary to ensure reasonable statewide access to, and availability for patients prescribed low-THC cannabis, referring to Texas Health and Safety Code Chapter 487 & Chapter 169, Occupations Code. These licenses pay a biennial renewal fee to maintain their license costing $318,511 every 2 years with an additional $530 registration fee for each occurrence. This comes after the initial $488,520 first two year license fee.

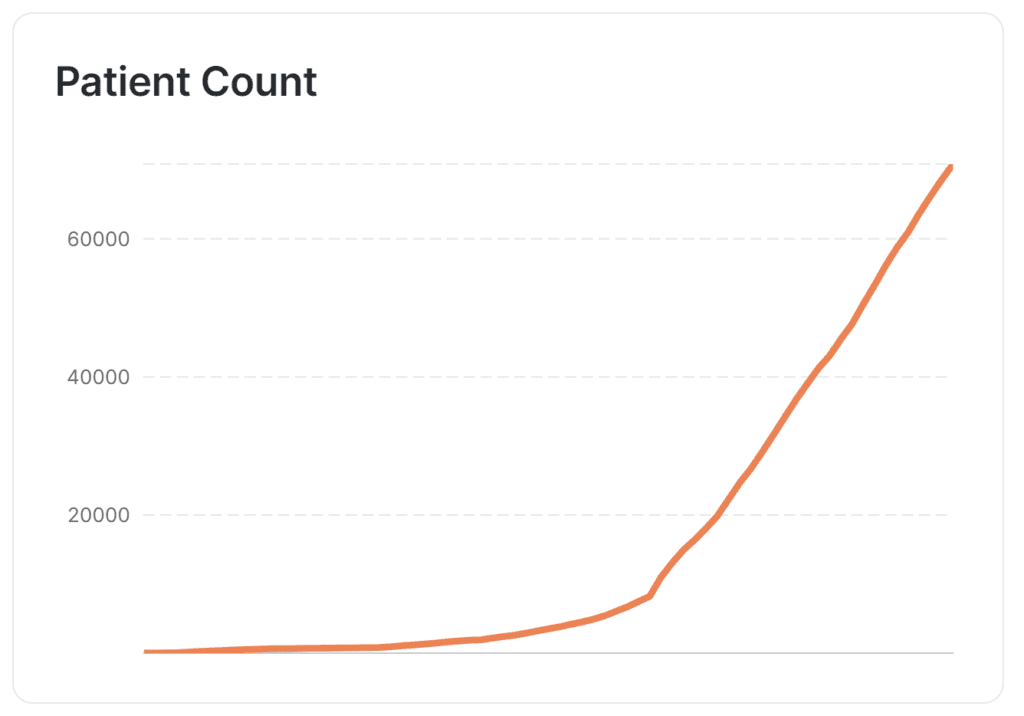

Though the stakes seem high for operators in a limited market that hasn’t grown since 2017 by supply of licenses, the demand has continued to grow throughout the years the program has operated by expanding medical conditions and patients who have exponentially registered. Conditions starting from epilepsy have increased to include Amyotrophic lateral sclerosis, Autism, Cancer, Epilepsy, Incurable neurodegenerative disease (Parkinson’s, MS, etc), Multiple sclerosis, Post-traumatic stress disorder, Seizure disorder, Spasticity, or Medical conditions designated by the Health and Human Services Commission as authorizing treatment with low-THC cannabis as part of an approved research program. In a recent 2023 session an effort to add Chronic Pain to the list to expand the program was voted down in the Texas state senate.

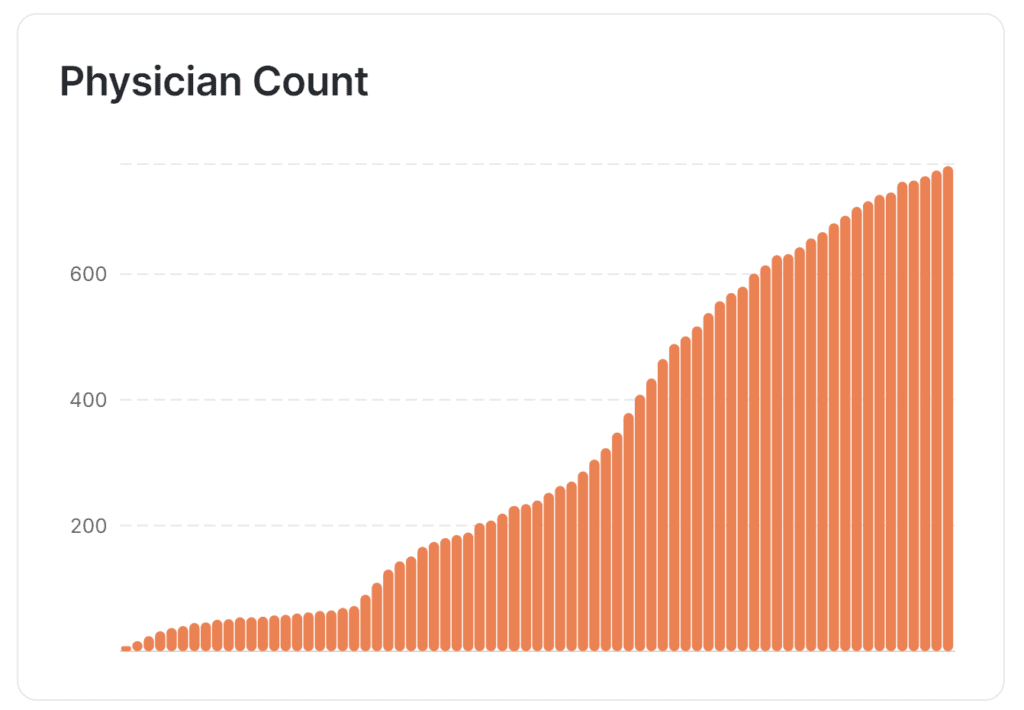

Through the years the patient registry data provided by DPS and illustrated by TexMedCannabis.com show patients have grown from 4 patients in November of 2017, to increase each year to 646 (2018), 1,187 (2019), 3,519 (2020), 14,926 (2021), 41,216 (2022), 70,835 (2023). In parallel the number of registered physicians has also increased from 8 in November of 2017 to 55 (2018), 143 (2019), 240 (2020), 489 (2021), 657 (2022), 772 (2023). Patients to get their medical card tend to spend hundreds of dollars annually while also having inflated priced cannabis medication.

Types of Cannabis Shops

Texas currently offers a limited variety of medical cannabis shop types, specifically accessible through in person dispensary (3), pick up location (dozens), or delivery to doorstep to cater to different consumer preferences and needs. Understanding the nuances of these establishments can significantly impact your cannabis shopping experience.

Dispensaries, delivery services, and pick up locations each provide distinct advantages and disadvantages. Dispensaries offer an in-person shopping experience with expert guidance, while delivery services provide convenience, and pick up locations land somewhere in the middle. Co-ops and lounges are not offered for social consumption. Knowing the differences between these options is essential for consumers to make informed choices.

Texas Medical Cannabis Providers

Goodblend Texas

A multi-state operateor (MSO) also known as Paralell

(https://tx.goodblend.com/)

Texas CUP License #0006 – issued Dec. 15, 2017

Austin, TX

Texas Original

A single-state operator (SSO) known as the local Texas organization

(https://texasoriginal.com/)

Texas CUP License #0005 – issued Oct. 31, 2017

Manchaca, TX

Fluent

A multi-state operateor (MSO) also known as Cansortium

(https://texas.getfluent.com/)

Texas CUP License #0004 – issued Sept. 1, 2017

Schulenburg, TX

Current Notable Medical Cannabis Brands & Products

Medical cannabis products are currently limited in the Texas market. These vertical operators have focused on owned and operated products that all use extraction methods, i.e. no smokable products in the state. Some existing products do have recognition for their quality and ratio varieties.

Edibles and Tincture: Surterra Wellness aka Goodblend Texas (https://tx.goodblend.com/shop)

Tincture: Fluent (https://texas.getfluent.com/shop/)

Tincture: Texas Original (https://texasoriginal.com/shop)

Topical: Surterra Wellness aka Goodblend Texas (https://tx.goodblend.com/shop)

The Texas cannabis landscape is an early one, characterized by trends in potential for product innovation, potency adjustment, and evolving consumer needs based on medical use case. Staying informed about these trends and discussing with their physician will allow consumers to discover products that align with what’s on shelves.

Geographic Distribution

The distribution of medical cannabis shops in Texas is far from uniform or with widely available access. A map showcasing the geographic distribution of these shops reveals the extent of the industry’s presence across the state.

Major cities like Houston, Dallas, and Austin boast a higher concentration of cannabis shops compared to rural areas. Many rural areas have little to no access.

Goodblend (Blue) | Texas Original (Green) | Fluent (Black)

Hemp Market Relevance

The Texas hemp market is a strong and growing market full of numerous products that meet the federal requirement of being below .03% THC per package. Throughout Texas and many nearby states, liquor stores, smoke shops, cbd stores, and other types of establishments are widely selling and distributing hemp products.

This less regulated program has a lower barrier to entry and consists of operators who lean into the looser definition of the federal hemp bill. Operators in this case could utilize psychoactive non-THC cannabinoids such as Delta-8 in balance with THCa and other cannabinoid varieties and use regular forms of delivery to reach a wider array of consumers. When formulating products by volume it is possible to provide products that could offer the same or similar benefit, potency, and quality to that of the 1% THC rule in Texas licensed medical cannabis rules.

For patients this presents a potential avenue where access could in theory be easier with lower cost options, though there is a higher risk of product offering due to the less regulated testing standards within the hemp market. We encourage any patients who are trying either hemp or medical cannabis products to consult with their doctor and utilize a measured approach.

2024 will be a big year for cannabis, where both hemp and cannabis see potential change with federal policy and regulations. How will this change or impact the Texas medical cannabis market? It could help bolster or hinder depending on the way regulations move. Staty tuned for more updates as they come.

EXPLORE MORE NEWS

Newsletter