In a more current assessment, recent research suggests that the public’s embrace of cannabis is steadily increasing, even as the illicit market maintains its presence. This study, conducted by New Frontier Data, a prominent cannabis consulting firm, involved surveys of nearly 4,400 cannabis consumers and 1,200 nonusers across the United States. The findings reveal a noteworthy surge in acceptance and consumption of cannabis over the past year.

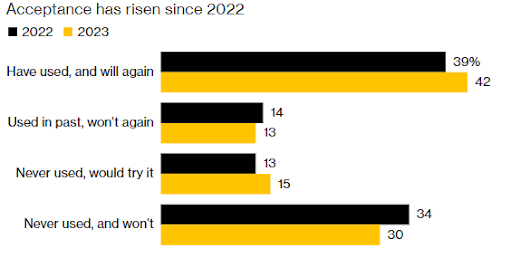

Despite the persistent financial and regulatory hurdles faced by the US cannabis industry, consumer attitudes towards cannabis remain overwhelmingly positive. The study demonstrates that a growing number of individuals are not only admitting to past cannabis use but also indicating their intention to use it again in the future. Approximately 42% of US consumers now fall into this category, compared to 39% a year ago. Conversely, the group of staunch cannabis skeptics has been shrinking, with only 30% stating that they had never used cannabis and had no plans to do so, down from 34% in the previous year. Moreover, a rising percentage of individuals are expressing willingness to experiment with cannabis for the first time, with only 13% firmly declaring that they would never use it again, a slight decrease from the figures in 2022.

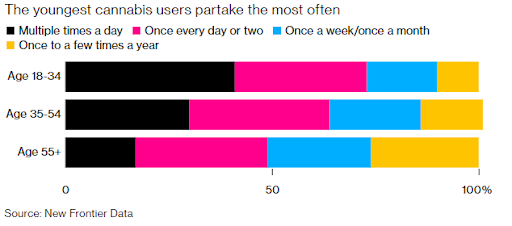

The data gleaned from this survey paints a picture of an increasingly cannabis-friendly US consumer base. Of particular interest is the revelation that 31% of cannabis consumers report using it multiple times a day. Among the 18 to 34 age group, this trend is even more pronounced, with 41% consuming cannabis multiple times daily. Although these percentages have slightly dipped compared to the previous year (36% and 46%, respectively), there is no sign of waning popularity for cannabis. As more states legalize its use, the cannabis industry is predicted to experience a 17% growth, reaching an estimated $34 billion in sales in 2023, as projected by New Frontier Data.

Interestingly, the study uncovers a growing acceptance of cannabis even in the face of unmet expectations regarding cannabis legalization. The initial goal of implementing state-licensed sales was to establish a secure supply chain, mitigate health risks, and dismantle the organized crime networks associated with the illicit market. However, contrary to these intentions, underground cannabis sales have continued to grow in recent years, reaching an estimated $77 billion in 2022, up from $70 billion in 2020, according to New Frontier Data’s estimates.

Nonetheless, the report does anticipate a decline in the illicit cannabis market, projecting it to be around $73 billion in 2023. In parallel, the legal cannabis market is anticipated to exhibit steady growth in the coming years, albeit with a modest decline in the illicit market.

Contrary to earlier hopes that cannabis would supplant alcohol use, the study reveals that cannabis users are more likely to consume alcohol and do so more frequently. While only 21% of cannabis nonusers report drinking alcohol a few times a week, the report finds that 34% of cannabis users consume alcohol with the same frequency.

Despite these positive trends and projections, cannabis stocks have faced a downturn in recent years, primarily due to the lack of significant progress toward federal legalization. While an increasing number of states are moving to legalize cannabis, federal lawmakers have grappled with reaching a consensus on legislation that would provide the industry with broader access to financial services or lead to full federal legalization. President Joe Biden’s call for a review of cannabis’s classification has also contributed to the uncertainty surrounding the industry’s future.

In conclusion, the latest study underscores the growing acceptance of cannabis among the public, with more individuals using it and expressing openness toward its use. Nevertheless, the illicit market remains a formidable challenge for the legal cannabis industry. The future of federal cannabis legalization remains uncertain, exerting an impact on the performance of cannabis-related stocks in recent years.

Source: Bloomberg

EXPLORE MORE NEWS

Newsletter