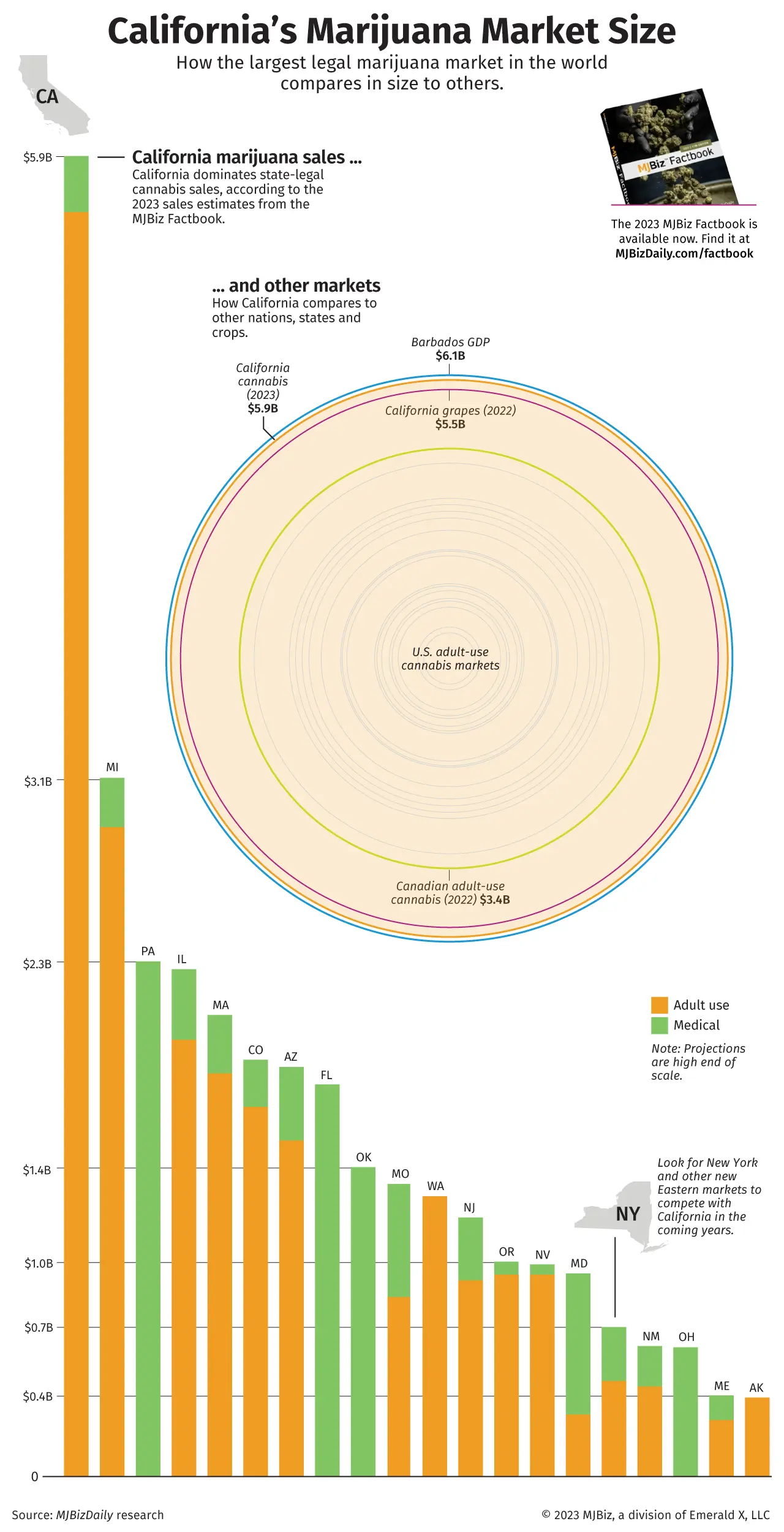

California’s Cannabis industry continues to dominate as the world’s largest cannabis market, despite facing financial and tax challenges. According to the recently published MJBiz Factbook, the state is estimated to generate nearly $5.9 billion in legal recreational and medical marijuana sales in 2023. To put this into perspective, the revenue from marijuana sales in California could support the economy of a small island nation.

The International Monetary Fund (IMF) projects that the gross domestic product (GDP) of Barbados, a Caribbean island nation, will reach $6.1 billion in 2023. Similarly, the GDP of Fiji, a South Pacific island, is projected to be approximately $5.4 billion this year.

The size of California’s cannabis market should come as no surprise, considering that its GDP in 2022 ($3.6 trillion) would rank fifth globally if the state were a country, positioning it between Germany ($4.2 trillion) and India ($3.2 trillion).

Furthermore, marijuana has emerged as one of California’s leading agricultural products, rivaling or even surpassing the value of two significant crops. In 2022, grape production, renowned for the state’s world-class wine industry, was valued at $5.5 billion, followed by almonds at $3.5 billion.

Compared to California, most other marijuana markets in the United States pale in comparison. Michigan, the second-largest American marijuana market in terms of sales, is projected to generate only half the consumer purchases of California in 2023, amounting to $3.1 billion in combined recreational and medical marijuana sales.

Despite being the global leader in sales, California’s marijuana industry faces various challenges. One such challenge is the impact of high taxes and local control, which has led to financial difficulties for businesses and investors. The burden of taxes imposed on cannabis products is significantly higher compared to other commodities. For example, while the state excise tax on a bottle of wine is only 4 cents, it amounts to $4.90 or over 100 times more for an eighth-ounce of cannabis. Moreover, the requirement for cannabis businesses to obtain permits from both local jurisdictions and the state has resulted in retail bans in many areas, effectively ceding a significant portion of the market to illegal operators.

These challenges have contributed to the persistence of the illicit market, which still accounts for two-thirds of cannabis purchases in California. Legal sales have experienced a decline for the past two years, exacerbating the financial strain on businesses and hindering the growth of the legal market. As a result, some well-capitalized businesses have withdrawn investments, describing the market as “brutal” and “toxic.” Addressing these challenges will be the key to unlocking the industry’s full potential in California. To do so will require immediate reforms that aim to reduce taxes, create a more favorable regulatory environment, and ensure that legal cannabis is more accessible and affordable for consumers. By doing so, the industry can compete more effectively with the illicit market, achieve the goals set forth in Proposition 64, and solidify California’s position as the global leader in the cannabis market.

Despirte these challenges, California is unlikely to face significant competition until other U.S. states with substantial populations, like New York, expand their marijuana markets or until states like Pennsylvania legalize recreational marijuana sales. The same applies to the opening of legal recreational markets in countries such as Germany.

Obtaining accurate data on legal cannabis sales in international markets is challenging. However, Canada, arguably the largest legal adult-use market outside the U.S., recorded only $3.4 billion in recreational sales in 2022.

To illustrate the magnitude of California’s marijuana market, here is an accompanying infographic that visually depicts its size.

Original article by: Andrew Long

Source: Mjbizdaily

EXPLORE MORE NEWS

Newsletter